Understanding the Bitcoin Bull Run

By Sarah Evans

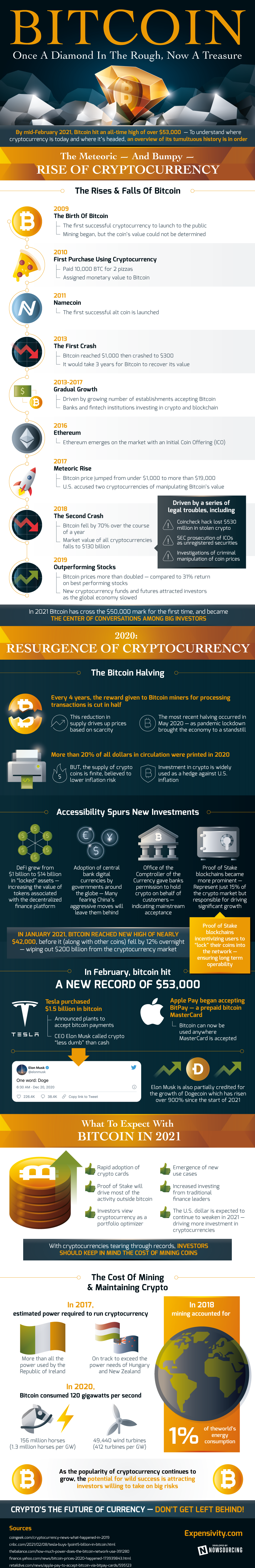

When bitcoin first released to the public in 2009, its value could not be determined. The first transaction to assign monetary worth to the cryptocurrency occurred in 2010 when someone paid 10,000 BTC for 2 pizzas. Since then, bitcoin has had an exciting history and maintained its spot in the cryptocurrency order against competitors. The first successful alt coin, namecoin, launched in 2011, but that did not deter bitcoin from gaining in value. 2 years later in 2013, bitcoin reached $1,000 for the first time before crashing to $300. It would take 3 years to recover.

While bitcoin rebuilt mid-decade, a growing number of establishments, banks, and fintech institutions agreed to accept crypto and blockchain. This increased access helped bitcoin’s reputation go mainstream. In 2017, bitcoin’s price leaped from under $1,000 to over $19,000. Unfortunately, this did not last; the US accused two cryptocurrencies of manipulating bitcoin’s value and the SEC prosecuted Initial Coin Offerings (ICOs) as unregistered securities, indicating a regulatory environment unfavorable to cryptocurrency. Bitcoin’s value once again fell by 70% over the course of 2018, but this time it rebounded faster. In 2019, bitcoin outperformed even the best stocks on the market. When the COVID-19 pandemic slowed the global economy a year later, bitcoin was poised to offer high returns to any investor willing to take the risk.

For many, that risk has paid off so far. In April 2021, bitcoin hit an all-time high of over $65,00. More than speculation, bitcoin’s rise is fueled by fears of inflation in the US dollar. More than 20% of all dollars in circulation were printed in 2020, but the supply of bitcoins is finite. To keep supply down, bitcoin halves the reward given to bitcoin miners for processing transactions every 4 years, the last of which occurred in May 2020.

Additionally, the regulatory environment has grown warmer to cryptocurrency in many countries over the past few years. The Office of the Comptroller of the Currency has given banks permission to hold crypto on behalf of customers, and numerous central banks are looking at digital currency after observing China’s move in the same direction. These moves have led major US companies to invest in bitcoin in a big way. Tesla recently purchased $1.5 billion in bitcoin and vowed to accept bitcoin as payments for its products. Apple Pay also began accepting BitPay, a prepaid MasterCard powered by bitcoin. Bitcoin can now be used to transact anywhere MasterCard is accepted.

As cryptocurrency grows in popularity, so too does the cost to mine and maintain the system. In 2018, mining of crypto accounted for 1% of the world’s energy consumption. 2 years later, bitcoin alone consumed 120 gigawatts per second. That’s the power equivalent of 49,440 wind turbines working simultaneously. While crypto offers many unique benefits to the world, it does not come without drawbacks. Knowledgeable investors should understand both before making a decision. Wild success exists for those who tolerate large risks.

Learn more about the bitcoin bull run …read more

Source:: Social Media Explorer