The Best Payroll Services (In-Depth Review)

By Neil Patel

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services simplify and streamline the process of paying your employees. They automate time-consuming tasks and give HR the tools they need to stay on top of taxes, benefits packages, paid time off, and other payroll factors.

Choosing the right payroll service is important, because they all do things a little differently. Let’s talk about the major features you are looking for and how to evaluate the top services available today.

The 6 Best Payroll Service Options for 2021

- Gusto – Best payroll service for small businesses

- OnPay – Most flexible payroll service

- Paychex – Best for larger organizations

- ADP – Best payroll service with built-in HR

- QuickBooks Payroll – Best for QuickBooks integration

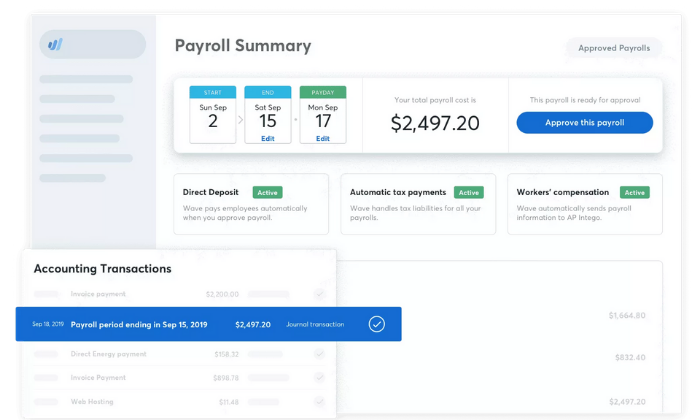

- Wave Payroll – Most affordable payroll service

How to Choose the Best Payroll Service for You

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Number of Employees

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors, because the process and fee structure may be different for each role.

Basic Payroll Features

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

- Automatic payroll options

- Self-service portal for full-time and part-time employees

- Mobile capability to manage payroll on the go

- Direct deposit so your employees get paid quickly

- Automatic tax calculations and withholdings

- W-2 and 1099 employee management

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

Tax Features

Filing tax is a complicated and time-consuming process. It can also result in unfortunate and expensive penalties if you don’t do it right.

Many payroll services offer tax features that simplify the process, like calculating payroll tax to automatically …read more

Source:: Kiss Metrics Blog