How to Lower Your Company COGS

By Neil Patel

Increasing sales isn’t necessarily the best way to improve your bottom line. A better solution may be to reduce your Cost of Goods Sold.

Paying less to acquire the products you sell can result in higher gross revenue figures and bigger profits, even when the amount of product you sell stays the same.

If you’re ready to make more money without selling more products, here’s a recap of COGS and specific strategies to lower expenses.

A Quick Recap of Cost of Goods Sold (COGS)

What Is Cost of Goods Sold?

The Cost of Goods Sold (COGS) is all the costs of producing and acquiring the products you sell. You can separate COGS into two parts: direct costs and indirect costs.

Direct costs are the expenses incurred when producing the products you sell. They include:

- raw material costs

- labor costs during production

- other production overheads

- the cost of wholesale products

Indirect costs are all the other expenses incurred when you manufacture products that aren’t tied directly to the process. They include:

- storage

- shipping

- labor

- custom duties

- software

- packaging costs

It’s also worth clarifying what COGS is not.

Your COGS is not the same as your operating expenses, for example. Both are expenditures, but operating expenses (also known as OPEX) are not tied to your products’ production. Instead, they include costs like rent, utilities, marketing, and legal.

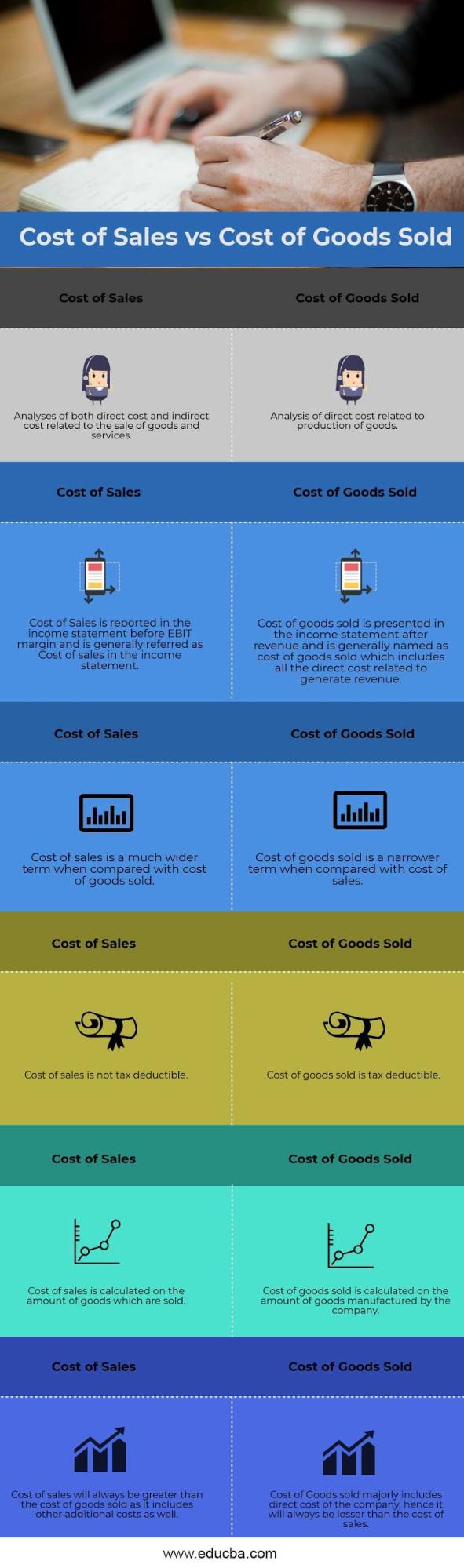

They also aren’t the cost of sales either, as this infographic from EDUCBA shows.

How Do I Calculate Cost of Goods Sold?

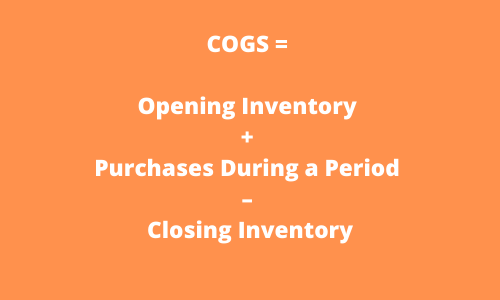

Businesses can calculate COGS using a standard formula that considers inventory levels and all of the direct and indirect costs listed above.

COGS = Opening Inventory + Purchases During a Period – Closing Inventory

- Opening Inventory is the value of inventory you hold at the start of a given period (like a financial year.)

- Product purchases and all resulting costs (as listed above) are added to the opening inventory.

- Closing inventory (the value of products that aren’t sold at the end of the period) is subtracted from that total to calculate the final Cost of Goods Sold.

Here’s an example:

Let’s say we want to calculate an e-commerce brand’s COGS during the 2019 financial year. The opening inventory would be the inventory recorded at the end of the 2018 fiscal year. Let’s say it’s $2 million.

The closing inventory would be the inventory recorded on the company’s balance sheet at the end of the 2019 fiscal year. Let’s say that is $3 million. Finally, the company purchased $5 million worth of inventory during the 2019 fiscal year.

The COGS for the 2019 financial year is:

2 + 5 – 3 = $4 million

The COGS is $4 million.

If you want to see what calculating COGS looks like in the real world, Investopedia provides an example using J.C. Penney’s 2016 financial report.

The calculation can also change depending on how you define closing inventory. There are three options:

- FIFO (first in, first out): The first item you add to your inventory is the first item that gets sold. …read more

Source:: Kiss Metrics Blog