How this year’s NewFronts factors into the upfront fight for streaming ad dollars

By Tim Peterson

The Interactive Advertising Bureau’s NewFronts has yet to emerge as its own marketplace à la TV’s annual upfronts. But this year — with a larger swath of the TV and streaming video market presenting — the NewFronts stands to play a bigger role in how ad dollars move between traditional TV and streaming in the TV upfront negotiations.

“There’s probably, for the first time, the most vendors that sell in the upfront time period that are [participating in the NewFronts],” said Cara Lewis, evp and head of U.S. media investment at Dentsu’s Amplifi. While longtime NewFronts stalwart Hulu is sitting out of this year’s presentations, TV network groups like A+E Networks and NBCUniversal will be presenting alongside other upfront participants like Amazon, Roku and YouTube.

“I definitely think we’re finally starting to see the NewFronts and upfronts merge,” said Jessica Brown, director of digital investment at GroupM.

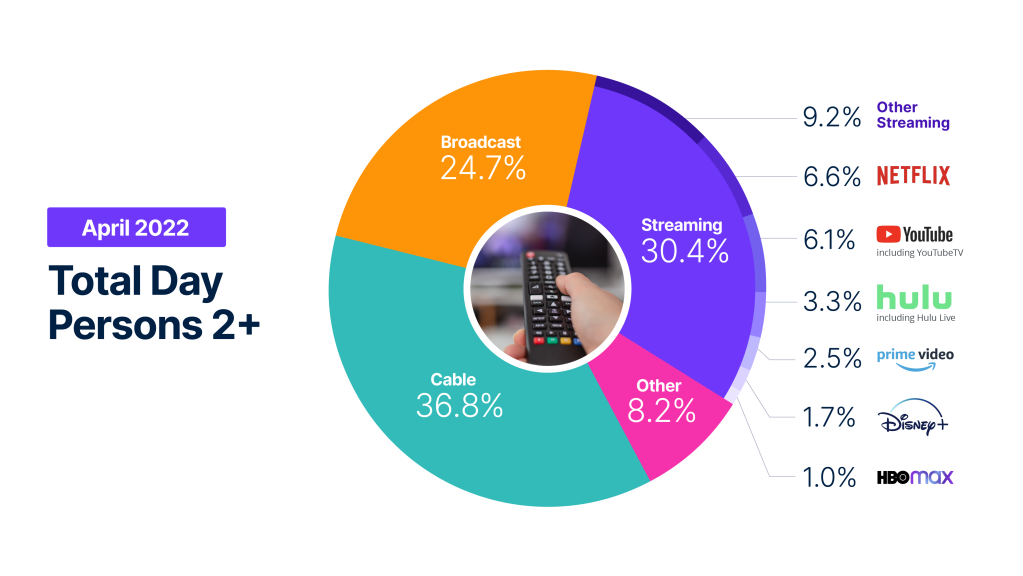

The prevalence of upfront participants at this year’s NewFronts seems to reflect the unsurprising expectation that more money will be shifting from traditional TV to streaming in this year’s negotiations. With TV networks rolling out standalone streaming properties, connected TV platforms pushing into original programming and digital video platforms seeing increased viewership on TV screens, the streaming landscape is flattening, pushing companies to use the NewFronts to showcase their streaming sales pitches.

“There’s so much content out there in general. People need to plant their flag and show what those differentials are,” said Stacie Danzis, vp of digital ad sales at A+E Networks, which did not present at NewFronts last year but has a portfolio of free, ad-supported 24/7 streaming channels to pitch this year. “I also think there are so many different layers and levels of premium that people are claiming that are out there that needs to be explained as well. A lot of these bigger places, they have these long-tail sites, they have syndicated extensions, they’re relying on short-form video that might not be qualified or UGC-focused.”

The TV network owners may be feeling the need to plant a flag at NewFronts not only because they have expanded their respective streaming footprints but also because pure-play streaming ad sellers are staking a bigger claim in the upfront. Over the past two years, platform owners including Amazon, Roku and YouTube have moved from taking a backseat to TV networks in the upfronts to last year negotiating with advertisers and agencies while upfront talks with the networks were still underway.

More to the point, the TV network owners need to prop up their streaming properties as the dynamic between linear TV and streaming’s roles approaches a point of inversion. Historically streaming was positioned as a complement to round out advertisers’ linear TV ad buys. However, “we’re getting to a point or are going to be at a point very soon where that’s flipped on its head. Streaming services will be the new reach vehicle. Television does not lend additional reach or incremental reach because it’s just getting older,” said one agency executive.

“A lot of …read more

Source:: Digiday