Future of TV Briefing: Sneak peek at Future of TV Week

By Tim Peterson

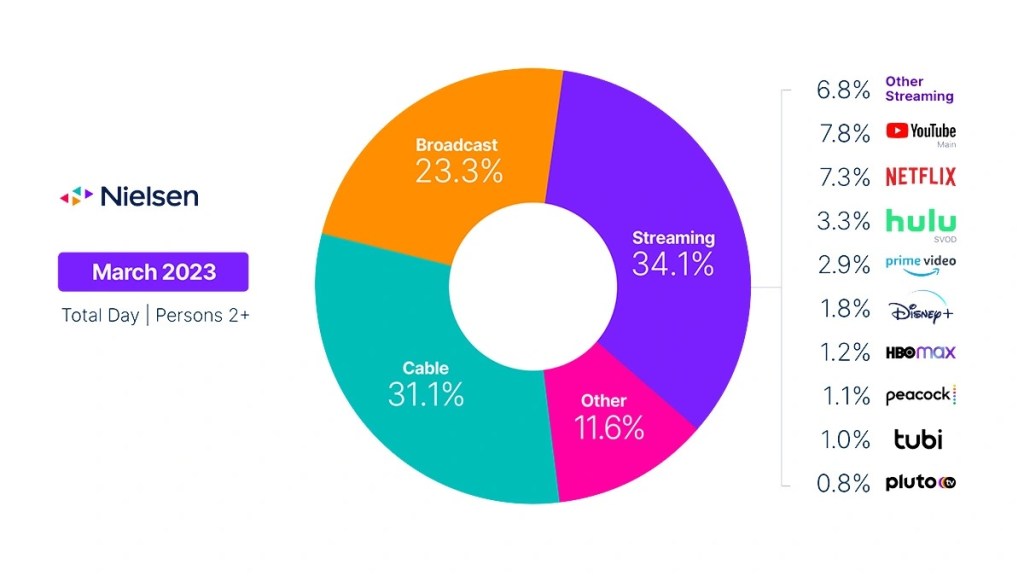

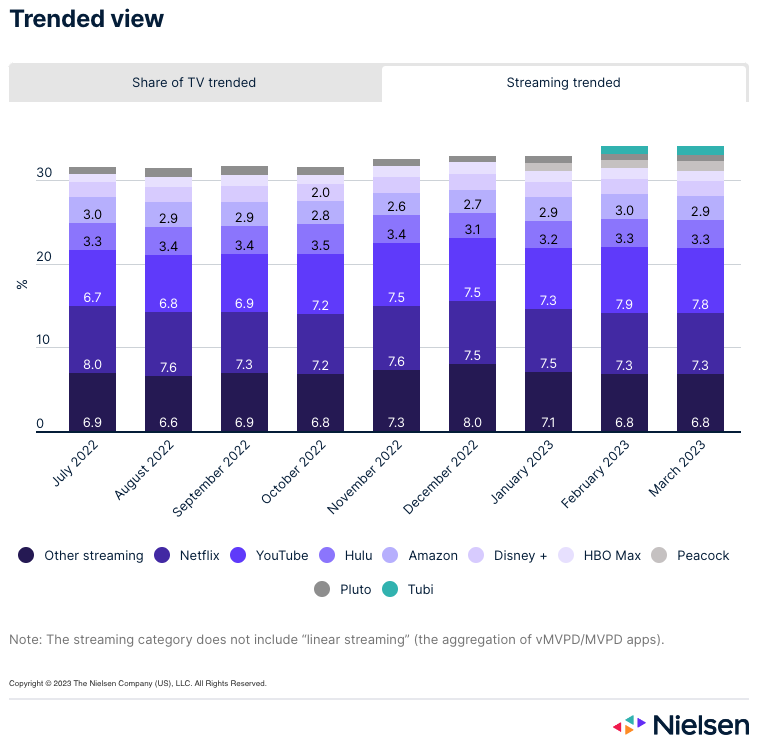

While overall TV viewership slipped a bit, how people spent their time watching TV remained largely consistent. Despite streaming ceding share for the first time since last August after a 0.2 share-point loss, the segment still held its lead over broadcast TV as well as cable TV, which notched a 0.6% share increase in March.

The breakdown of watch time within the streaming segment in March was also almost virtually unchanged from February. None of the specified streamers gained or lost more than 0.1 percentage points. In fact, Pluto TV was the only service to gain share, though it remained shy of reaching 1% share of total TV viewership after having only met that mark in September 2022.

What we’ve covered

Why creator Kat Stickler isn’t worried about a possible TikTok ban:

- While Stickler has nearly 10 million followers on TikTok, she’s also amassed more than 1 million on Instagram.

- She has seen brands pull back from TikTok-centric deals in light of the potential ban.

This week’s Future of TV Briefing looks at Digiday’s upcoming five-part video series on the present and future of the TV, streaming and digital video advertising business.

- Stay tuned

- Netflix’s Q1 2023 earnings report

- TV, streaming watch time slips

- Warner Bros. Discovery’s Max hedge, Major League Baseball’s streaming ambitions, Netflix’s new ad options and more

- Next week Digiday will premiere a five-part video series on the TV, streaming and digital video ad business.

- Topics covered include expectations for this year’s upfront market; the state of the streaming ad market; TikTok vs. Instagram Reels vs. YouTube Shorts vs. Snapchat; the connected TV ad tech turf war; and the industry’s ad measurement overhaul.

- Episodes will feature interviews with executives from companies including Digitas, GroupM, Horizon Media, K18 Hair, Omnicom Media Group, Tinuiti and UM Worldwide.

Stay tuned

The key hits:

The Future of TV is approaching. Well, “The Future of TV.” The five-part video series will premiere on April 24 as part of Digiday’s Future of TV Week and assess the state of the TV, streaming and digital video advertising business from the buy-side perspective.

What are the dynamics at play heading into this year’s annual TV advertising upfront market? How is the streaming ad market shaping up and shaking out, now that Netflix and Disney+ are in the mix? Similarly, what’s the status of marketers’ short-form vertical video strategies in light of a potential TikTok ban? How are advertisers’ arming themselves with ad tech to sort through the connected TV ad supply chain? And, of course, what does TV advertising’s measurement makeover and the impending multi-currency era portend?

These are among the questions that agency and brand executives will discuss throughout the series. In addition to interviews with industry experts, the series will feature findings from a recent Digiday+ Research survey of CMOs, as well as explainer skits. Here’s a sample of the topics to be covered in “The Future of TV.”

The TV ad market’s inflection point

The TV ad market has been on the verge of a tipping point for years. Traditional TV reach has been eroding, and ad-supported streaming viewership has been growing — and the ever-present question is, at what point will the overall TV ad market tip toward streaming once and likely for all? Could it be this year? That’s the question that investment chiefs from Horizon Media, OMD and UM Worldwide weigh in on to kick off the first episode before wading into how recent developments in the TV, streaming and digital video ad markets seem set to culminate in what could be a watershed year for not only the upfront market — and the upfront model — but the industry overall.

Streaming’s supply-demand dynamic

Advertisers are seemingly swimming in streaming ad inventory. Netflix has finally joined the ad-supported streaming landscape, and so has Disney+. And yes, advertisers are awash in streaming ad options. In fact, in the series’ second episode, agency executives from Havas Media, Horizon Media, PMG and Tatari say streaming ad supply currently outstrips advertiser demand. And yet, advertisers are feeling a little limited with …read more

Source:: Digiday