Future of TV Briefing: How soft will this year’s TV upfront cycle be? Timing will tell

By Tim Peterson

This week’s Future of TV Briefing looks at TV network executives’ expectations for this year’s likely softer upfront cycle.

- Upfront or downfront?

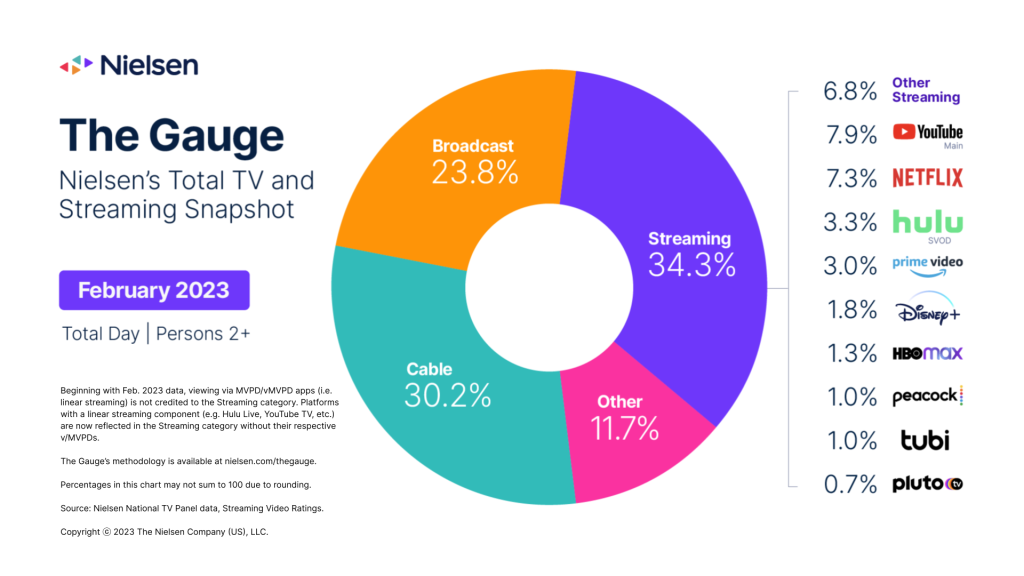

- Tubi cracks Nielsen’s revamped TV watch time report

- Netflix’s ad-supported subscriber base grows, TikTok creators prepare for potential ban, NBA eyes streaming payday and more

- This year’s upfront market is unlikely to be as robust as the past two cycles.

- Newer upfront advertisers, like gambling, cryptocurrency and tech brands, may be especially noncommittal.

- The timing of this year’s marketplace will likely be a major factor in its outcome.

Upfront or downfront?

The key hits:

This year’s annual TV advertising upfront cycle is looking like it will be neither a celebratory nor somber affair. Instead it’s shaping up to be somewhat sober.

While TV networks are starting to see some green shoots after the ad market went cold over the winter, for now network executives are not exactly expecting to come out of this year’s negotiations claiming big price increases and record amounts of money committed as they have in the past. However, that could change depending, in part, on how sellers time this year’s upfront marketplace.

Advertisers continue to clutch their budgets amid the economic downturn, and TV ad sellers are largely aiming to retain the level of money committed a year ago, splitting the difference between those concerned that commitment amounts will come in lower than last year and those conceiving an up upfront.

“A big part of what I’m hearing from all the buyers is volume will be down, specifically in linear,” said one TV network executive.

A second TV network executive echoed that assertion. “What I’m hearing from my closer sources is there’s elements inside the agencies [saying], ‘This should be a massive rollback marketplace,’” said this executive. “Let’s caution that. There’s still supply-chain challenges. But I think it’s a modest marketplace.”

Other TV network executives either said they expect this year’s upfront commitment amounts to be flat to up by low-single-digit percentages compared to last year or opted not to try to read the tea leaves when the economic picture remains so murky.

“I don’t think it’s going to be crazy, crazy robust, but I don’t think it’s down,” said a third TV network executive. “I think it might be up slightly, single digits. Agencies are saying it’s flat. If agencies are saying it’s flat, that means it’s probably up.”

“The reality is that uncertainty is not great for upfront marketplaces. There could be some hesitation. On the other hand, there are definite category turnarounds,” said a fourth TV network executive.

Indeed. CPG advertisers have weathered their supply-chain challenges. Pharma and entertainment advertisers continue to spend. And ad dollars from auto brands are making their way back into the market.

Nonetheless, according to a survey of more than 300 brand and agency executives in the U.S. that research firm Advertiser Perceptions conducted in February, only 27% of buy-side respondents said they expect to increase their upfront spending this year. By comparison, 51% increased their upfront spending in 2022.

“I do think that this year is going to …read more

Source:: Digiday