Future of TV Briefing: How Amazon, Roku and YouTube are figuring into this year’s TV upfront market

By Tim Peterson

This week’s Future of TV Briefing looks at how Amazon, Roku and YouTube stand to play a bigger role in this year’s upfront market after leveling up in the last couple years.

- Upstream TV

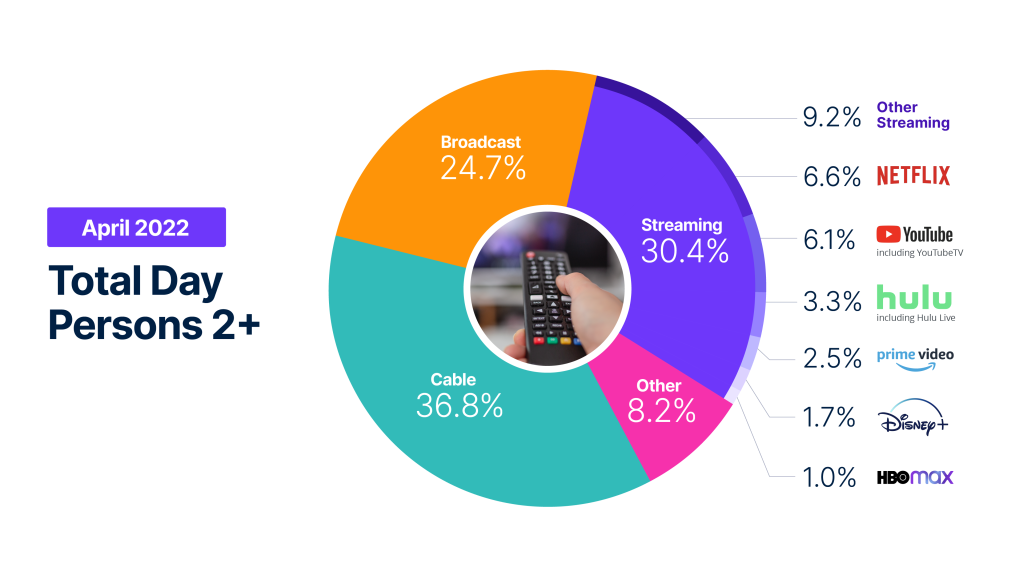

- Streaming viewership hits highwater mark

- Streaming’s belt-tightening era, Netflix’s long-term subscriber loss, TikTok’s live subscriptions test and more

Upstream TV

The key hits:

- The upfront gap between traditional TV networks and streaming-only sellers has closed.

- This year some agencies may strike their first upfront deals with Amazon, Roku and YouTube.

- The streaming-only sellers’ flexible upfront deals models also factor in, though those models may be changing this year.

In last year’s TV advertising upfront market, TV networks were willing to turn away linear TV ad dollars to move money to their respective streaming and digital properties. In this year’s upfront market, that move may come back to bite the networks. Some of that money did end up moving to streaming and digital, but it moved to other companies’ streaming and digital inventory and may not return to the TV networks given Amazon’s, Roku’s and YouTube’s rising roles in the upfront market, according to agency executives.

“We warned [the TV networks] last year: ‘Don’t overplay your hand because all your going to do is you’re going to force clients to shift money into some of these digital platforms that have great audiences, data, great measurement, great ability to prove that they’re reaching incremental audiences that you’re not reaching on TV. And once the money goes over, they’re not coming back,’” said one agency executive.

“People thought they could push money away, and it would just come back, and it doesn’t,” concurred a second agency executive.

This migration of money to companies including Amazon, Roku and YouTube is creating the conditions for the playing field to further level between traditional TV network owners and streaming-only sellers in this year’s upfront. “NBCU, Disney, Fox, Warner Bros. Discovery, Paramount, Amazon, Google, Roku — that’s where 80% of the marketplace gets spent,” said a third agency executive.

Historically, the streaming-only sellers took a backseat to the TV networks in the upfront negotiations. Advertisers and agencies struck their deals with the TV networks first and then moved on to haggling with Amazon, Roku and YouTube. But over the past two years, that gap has effectively closed to the point where, in some cases, the streaming-only sellers are securing the first deals.

“YouTube’s been one of our first deals a couple of years in a row, as has Roku,” said Stacey Stewart, U.S. chief marketplace officer at UM Worldwide. “Whether they will be this year, time will tell. We look at them all at the same time. We don’t have windows anymore.”

“You’re going to see more agencies and clients push for broader deals or bigger deals across YouTube, Roku, Amazon, for sure,” said the second agency executive.

Agency executives were leery of discussing, on record or anonymously, what share of upfront dollars they expect will go to the streaming-only sellers versus the TV networks this year, but they did say that they …read more

Source:: Digiday