Future of TV Briefing: Ad-supported streaming enters the broadcast era

By Tim Peterson

The surprising thing about the dominance of the “other digital video” category is that it excludes what are typically considered the primary recipients of advertisers’ digital video dollars. It does not include major ad-supported streamers like Hulu, Pluto TV or YouTube TV. And it doesn’t include digital video platforms like YouTube and TikTok, both of which are bucketed as “social video” to their likely chagrin.

Instead, the IAB’s report defines “other digital video” as “short-form video from web/app-based publishers.” Vague as that definition is, by deducing the excluded digital video sources, “other digital video” seems to refer to the not-so-premium forms of digital video, such as the videos that publishers inject into text-based article pages simply in order to have video ad inventory to sell.

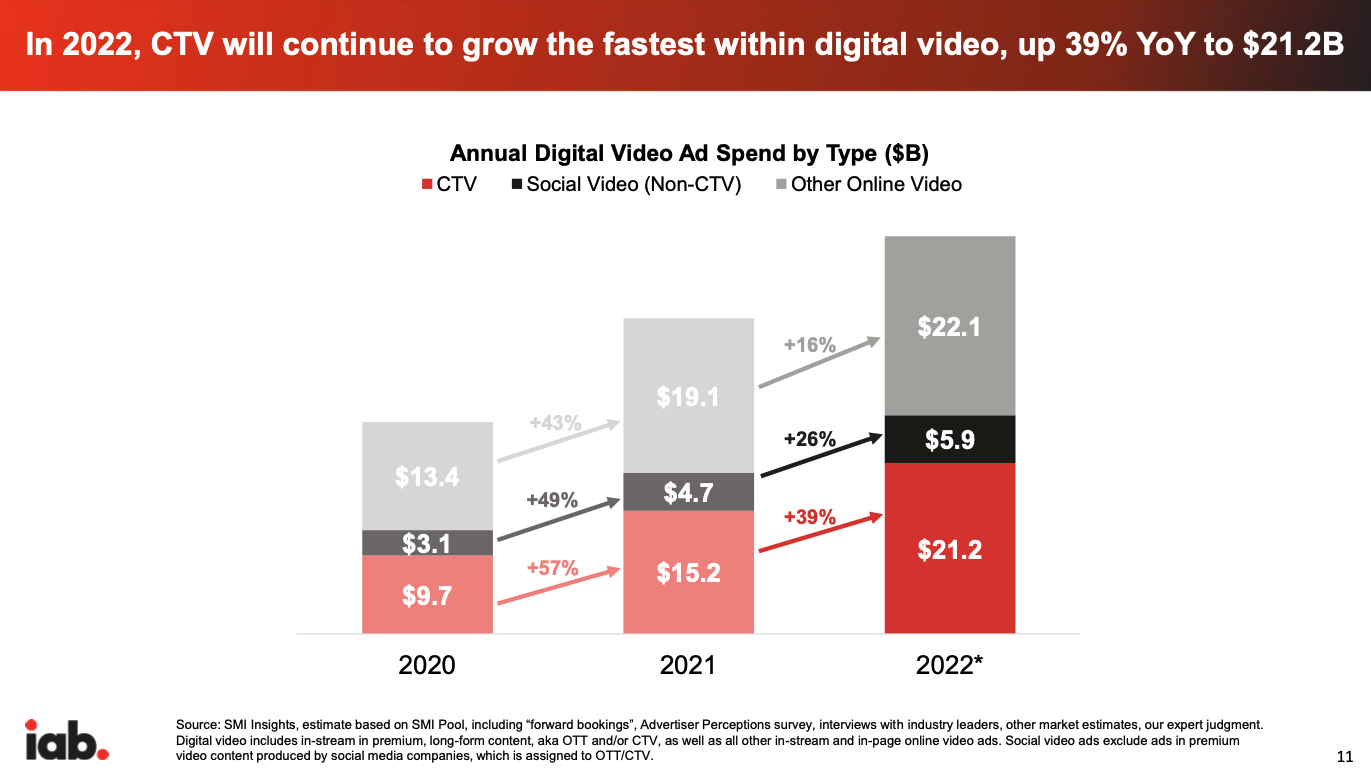

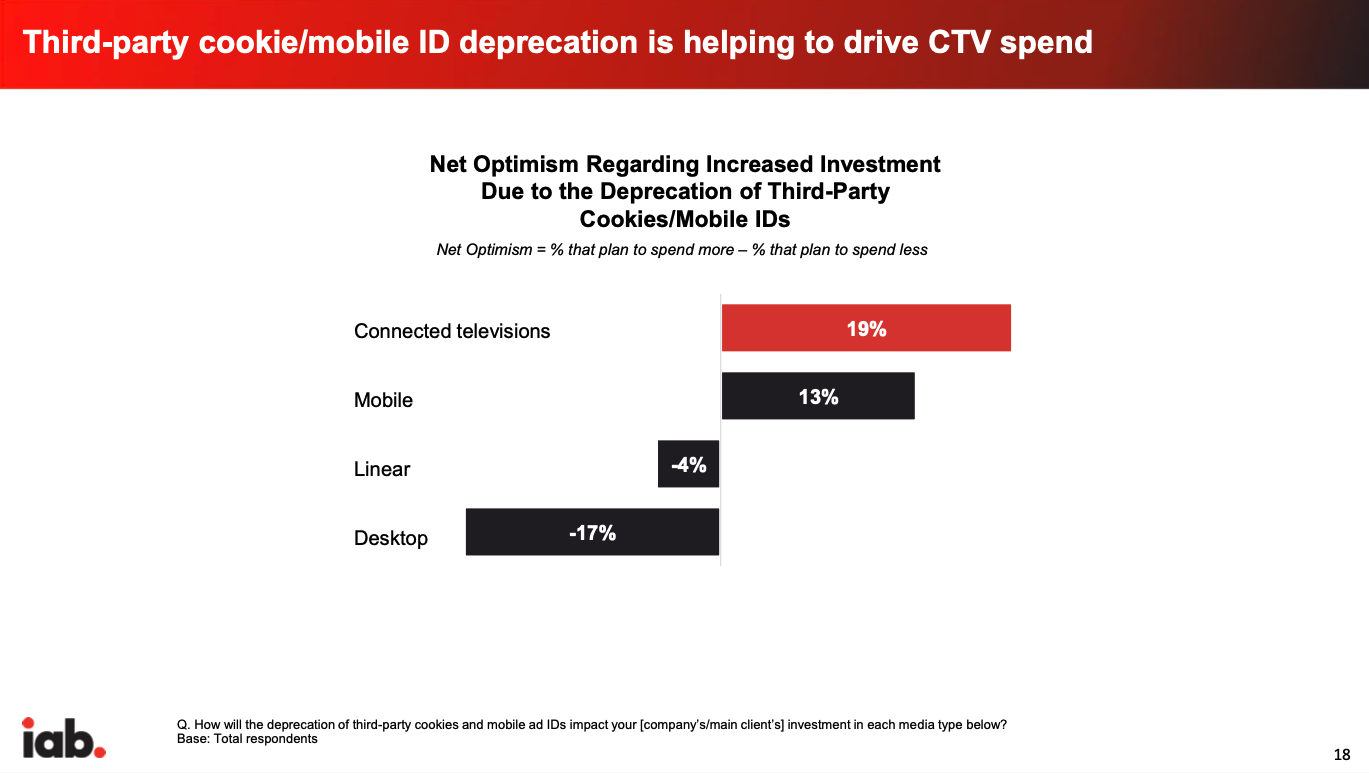

To be clear, CTV is ascendant. The amount of money going to CTV advertising is growing at a quicker clip than either “other digital video” or social video. And CTV seems to be on pace to take the leading share of digital video dollars next year. But among the factors fueling that will be the deprecation of third-party cookies and mobile IDs.

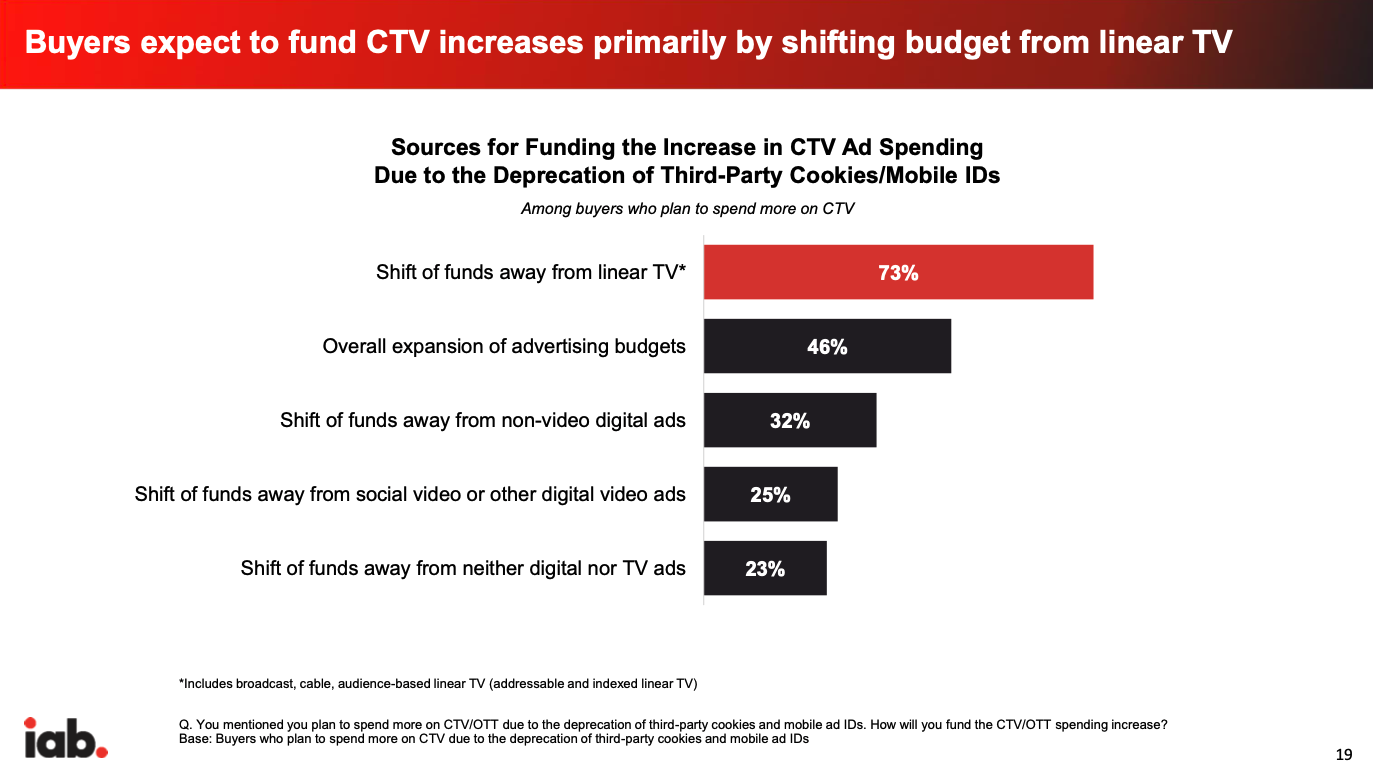

In other words, as much as CTV on its own may be attractive to advertisers, it is being aided by the fact that that “other digital video” bucket — appealing to advertisers for being cheap and easy to measure and attribute — is becoming unappealing because of the looming limitations advertisers will face in measuring and attributing their online video ads. And even then, only 25% of an undisclosed number of surveyed ad buyers said they plan to shift money away from social video or other digital video ads.

What we’ve covered

CTV platforms and ad-supported streamers kick off NewFronts Day 1:

- TV and tech companies, including Amazon, Fox’s Tubi, NBCUniversal’s Peacock and Vizio, talked up the coming together of traditional TV and streaming.

- The announcements revealed new products designed to insert advertisers into the programming as well as to evaluate the performance of advertisers’ streaming campaigns.

This week’s Future of TV Briefing looks at how Netflix’s and Disney+’s plans to add ad-supported tiers are ushering in the broadcast era of streaming.

- The new broadcasters

- Paramount’s Q1 2022 earnings report

- CTV’s “other” rival for ad dollars

- Roku sees Starz, Vice Studios for sale, Comcast-Charter’s CTV foray, Twitch’s financial tweaks and more

The new broadcasters

The key hits:

- Disney+, HBO Max-Discovery+, Hulu, Netflix, Peacock and Paramount+ stand to be the ad-supported streaming equivalents to broadcast TV networks.

- The rise of these streaming broadcasters could help to consolidate the streaming ad market for advertisers if ad-supported streaming audiences coalesce around them.

- But this consolidation risks recreating traditional TV’s seller’s market within streaming — unless ad buyers are able to successfully broaden the definition of TV.

With Netflix and Disney+ planning to add ad-supported tiers, the ad-supported streaming market is entering its broadcast era. The rounding out of major ad-supported streamers should help to shore up the relative lack of supply in the streaming ad market for advertisers. However, ad buyers are wary of consolidation at the top recreating and reinforcing the unfavorable-to-advertisers economics of traditional TV.

Credit to Brad Stockton, svp of U.S. national video innovation at Dentsu, for coming up with the concept that, by adding ad-supported tiers, major subscription-based streamers are becoming the streaming equivalent to traditional broadcast TV networks (and for doing so even before Netflix’s announcement). It’s an analogy that other agency executives agree with and welcome.

“I love the idea of the broadcast era because that’s gonna change things dramatically. Obviously, people went to those services so that they didn’t see ads, and now there’s an option there, but we get to crack into that space too,” said Connelly Partners partner and director of media services Michelle Capasso during the Digiday Business of TV Forum on April 21.

The idea of streaming broadcasters is also a concept that broadcast TV network owners seem to be embracing.

Consider what’s happening with Hulu. Originally jointly owned by broadcasters ABC, Fox and NBC to serve as their streaming outlet, Disney assuming ownership of Hulu has coincided with NBCUniversal beginning to take its programming off Hulu to put it on Peacock, which is now its chosen streaming outlet.

Other major broadcasters are making similar moves by plugging their own streamers with their linear programming — Paramount-owned CBS with Paramount+ and Disney-owned ABC with Hulu and Disney+ — all of which will be ad-supported by the end of this year. Add Warner Bros. Discovery’s HBO Max and Discovery+, which are slated to combine into a single service, and eventually Netflix to the mix, and this is the lineup of streaming broadcasters that Stockton and others are referring to.

“The big six apps are the broadcast partners,” said one agency executive.

This streaming broadcaster concept would seem to overlook the free, ad-supported streaming TV services, like Paramount’s Pluto TV, Roku’s The Roku Channel and Amazon’s Amazon Freevee, which would seem better suited to become broadcast TV’s heirs apparent given audiences’ free access to them. But for years, the FAST services have been considered …read more

Source:: Digiday