Future of TV Briefing: 3 questions heading into this year’s TV upfront negotiations

By Tim Peterson

This week’s Future of TV Briefing looks at a few of the top questions on the minds of both buyers and sellers as this year’s annual buying cycle commences.

- Up in the air

- Is long-form vertical video financially viable?

- Warner Bros. Discovery’s streaming tiers, Nielsen’s MRC accreditation, NFL Sunday Ticket’s streaming suitors and more

Up in the air

The key hits:

- What measurement providers will gain adoption?

- Are business outcome guarantees back on the table?

- Was flexibility just a fad?

This year’s TV advertising upfront market seems set to be unlike any other — which is a description that was applied to each of the past two annual negotiating cycles. And yet it’s true (once again).

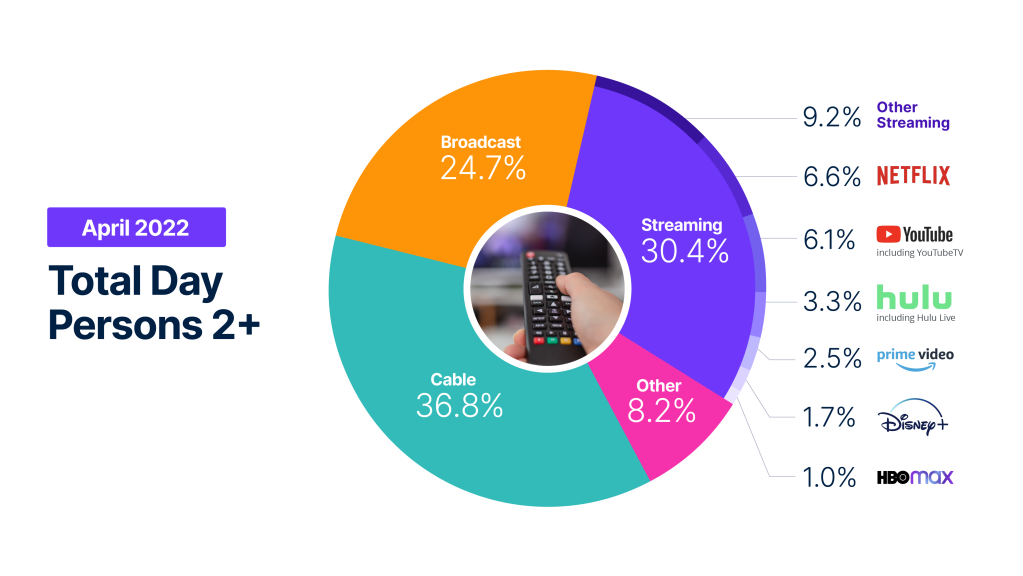

There remain the trends that were top topics during the most recent rounds of advertisers and their agencies haggling with TV network owners and streaming-only sellers, like the erosion of linear TV audiences and rise of streaming viewership. There also continue to be recurring questions, like how much higher can linear TV ad prices rise and when will streaming ad rates drop by comparison or when will programmatic gain preference. And then there’s the measurement makeover, which is what stands to make this upfront a singular cycle (at least until next year).

So, with preliminary discussions between buyers and sellers already starting up in recent weeks, here are a few questions on the minds of both sides heading into this year’s negotiations.

What measurement providers will gain adoption?

Measurement is the major question heading into this year’s upfront negotiations and by a wide margin. “Measurement is the biggest one,” said one agency executive.

“I spent the bulk of the past two weeks talking about alternate campaign measurement. That is the topic of this upfront,” said a second agency executive.

The main measurement question surrounds which are the measurement providers that advertisers and TV network owners will adopt as alternative currencies to Nielsen. Both buyers and sellers still expect Nielsen to be the primary currency, but they will be setting the non-Nielsen providers as “shadow currencies” in order to put in place baselines for future upfront commitments.

However, some advertisers may opt to adopt the alternative currencies as primary currencies because they are new or newer to the upfront market and may view them as a way to somewhat future-proof their upfront prices by setting rates on these alternative currencies at a time when the value of an impression, for example, is still being calculated and may only appreciate in the years to come.

“If you’re a cryptocurrency or a DTC [brand] and never worked in TV, it’s a good opportunity to bring those clients to the forefront and establish their bases on a new currency,” said a third agency executive.

Are business outcome guarantees back on the table?

Prior to the pandemic, advertisers and TV networks had begun including components in their upfront agreements that guaranteed campaigns would generate specific business outcomes, like a certain percentage lift in sales. Then the pandemic happened, and no one was trying to make any kind of assurance.

Now business outcome …read more

Source:: Digiday