Future of TV Briefing: Smart TV makers seek to steal the screen

By Tim Peterson

This week’s Future of TV Briefing looks at how Roku’s push into the smart TV manufacturing business reflects the changing state of the connected TV market.

- Big-screen battle

- Why TV advertising’s upfront model won’t fade away

- WTF is the U.S. Joint Industry Committee?

- Netflix’s TV chief, the TV-to-streaming-to-short-form turning point, Roku’s misinformation problem, Nielsen’s new measurement service and more

Big-screen battle

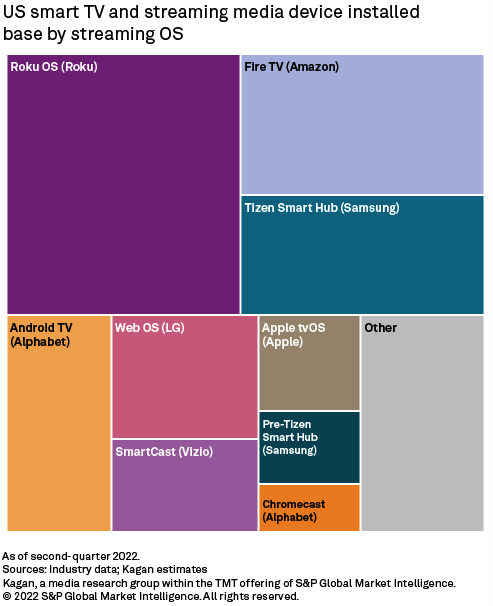

Roku’s decision to start making its own smart TVs now seems to reflect two shifts happening in the connected TV hardware market: Smart TVs are usurping CTV devices (dongles, sticks, pucks, etc.) as the popular means of connecting a TV to streaming services, and smart TV makers are becoming more powerful players in the overall CTV platform market.

“Roku is probably thinking ‘we’d better be making TVs as well to at the very least hedge ourselves and maybe protect ourselves from whatever further competition might evolve,’” said Tim Nollen, senior media tech analyst at investment bank Macquarie.

Roku has risen to have a dominant share of the U.S. CTV market. In the third quarter of 2022, its devices accounted for 40% of the CTV devices installed in the U.S., according to market research and consulting firm Parks Associates. And in the second quarter of 2022, 33% of the time people in North America spent streaming video on any device — TV, phone, computer, etc. — occurred on a Roku-powered TV, more than any other platform including Amazon’s Fire TV, Samsung’s smart TV and Apple’s iOS, according to video measurement and analytics firm Conviva.

However, outside the U.S., Roku’s position isn’t so dominant. In Africa, Asia, Europe, Latin America and Oceania, Roku didn’t even crack the top five of devices by watch time in Conviva’s report.

While Roku announced last week that it has 70 million active accounts — up from 65.4 million at the end of Q3 2022 — “Roku is still mostly just U.S. They haven’t had much success outside,” said Alan Wolk, co-founder and lead analyst for consulting firm TVRev.

To be clear, Roku has only announced plans to sell its smart TVs in the U.S. So getting into the smart TV hardware business won’t necessarily help the company internationally anytime soon. But it could help to protect the company’s business domestically.

Smart TVs in general have overtaken CTV devices in popularity, accounting for 35.3% of streaming video viewing time in Q2 2022 versus 34.6% for CTV devices, per Conviva. And the smart TV’s preeminence seems to have spurred CTV device makers to get into the business of making their own internet-connected televisions. In September 2021, Amazon unveiled its own line of smart TVs. Comcast followed suit in October 2021 and then formed a joint venture with fellow pay-TV provider Charter called Xumo that plans to roll out a line of smart TVs this year.

Not only is the smart TV market is getting more crowded, but it’s featuring more companies that own both the TV screen and the CTV platform powering it. That could lead the …read more

Source:: Digiday