2023 is Going to be Bad for Marketing, But There’s Hope

By Neil Patel

If you just look at the data, it paints a very grim future for marketing… at least in the short run.

For example, we may go into a global recession as the Federal Reserve continually increases interest rates and it has caused businesses to cut back.

Especially on the advertising front.

Just look at the recent earnings calls from advertising giants. Alphabet only slightly increased advertising revenue in total, although YouTube decreased by roughly 2%.

They are also seeing massive pullbacks in some large industries. For example, there has been a pullback in crypto, mortgage, insurance, and even gaming ad spend.

And it’s even worse for Meta. Their average revenue per user has dropped to $9.41 versus $9.83.

They also stated that their Q4 revenue, which mainly comes from advertising, is lower than most predicted with a range of $30 to $32.5 billion.

Snap had a similar story to the other online ad platforms, while Pinterest grew 8% a year which was more than analysts expected.

Nonetheless, no matter what platform you look at, it’s safe to say that the advertising industry is seeing a slowdown.

Now let’s dive into the obvious bad news, and then we will get into the silver lining and how you should adapt. Because there is hope and you can still do well in this market.

Bad news

The marketing industry is going in a downward direction fast. I’m no economist, but most of it is related to external factors none of us can control… such as rising interest rates, supply chain issues, increases in oil and energy prices, issues with real estate across the world, and worst of all, war.

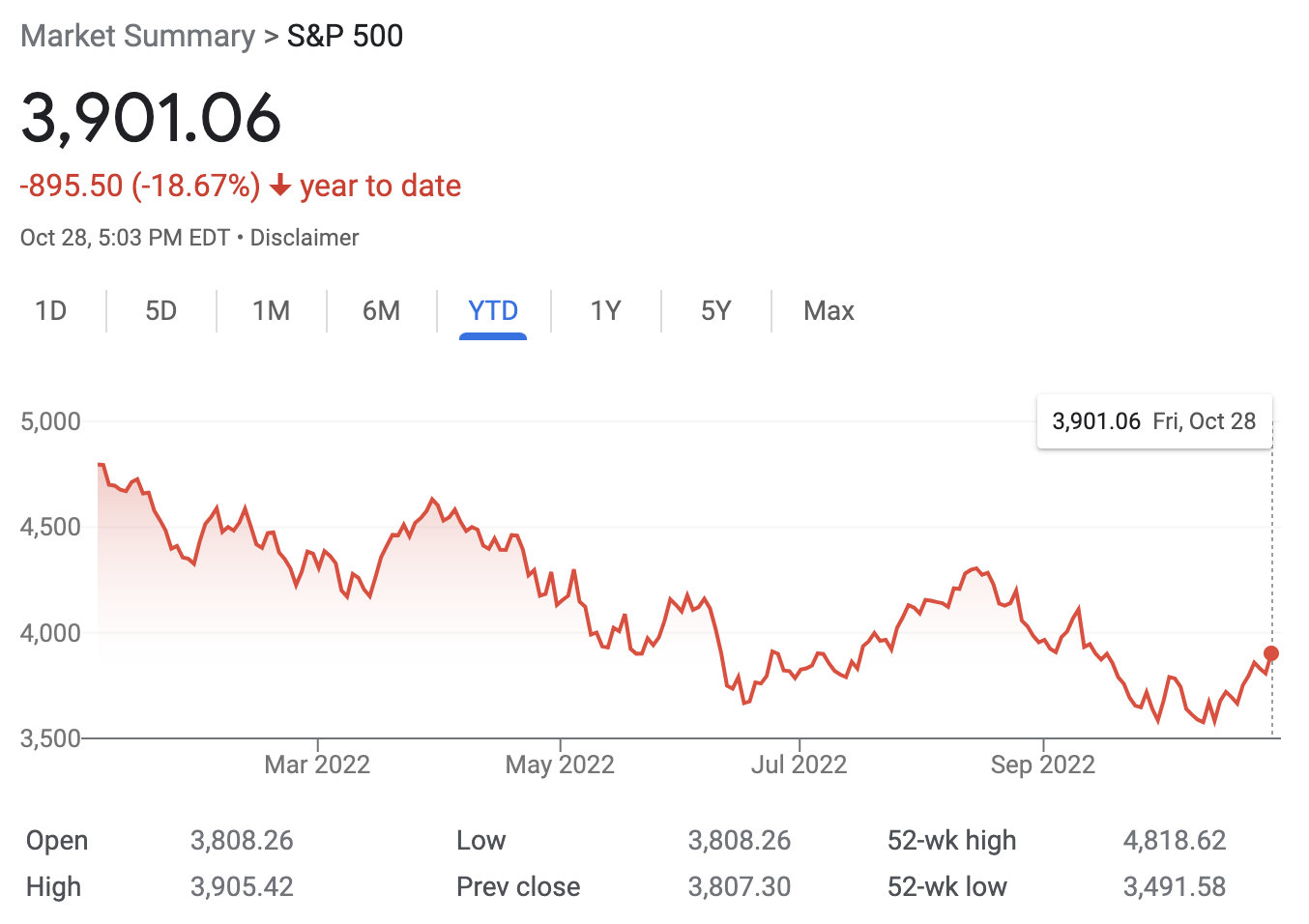

And when you have the S&P 500 down 18.67% it means companies have lost a lot of money… and I mean a lot.

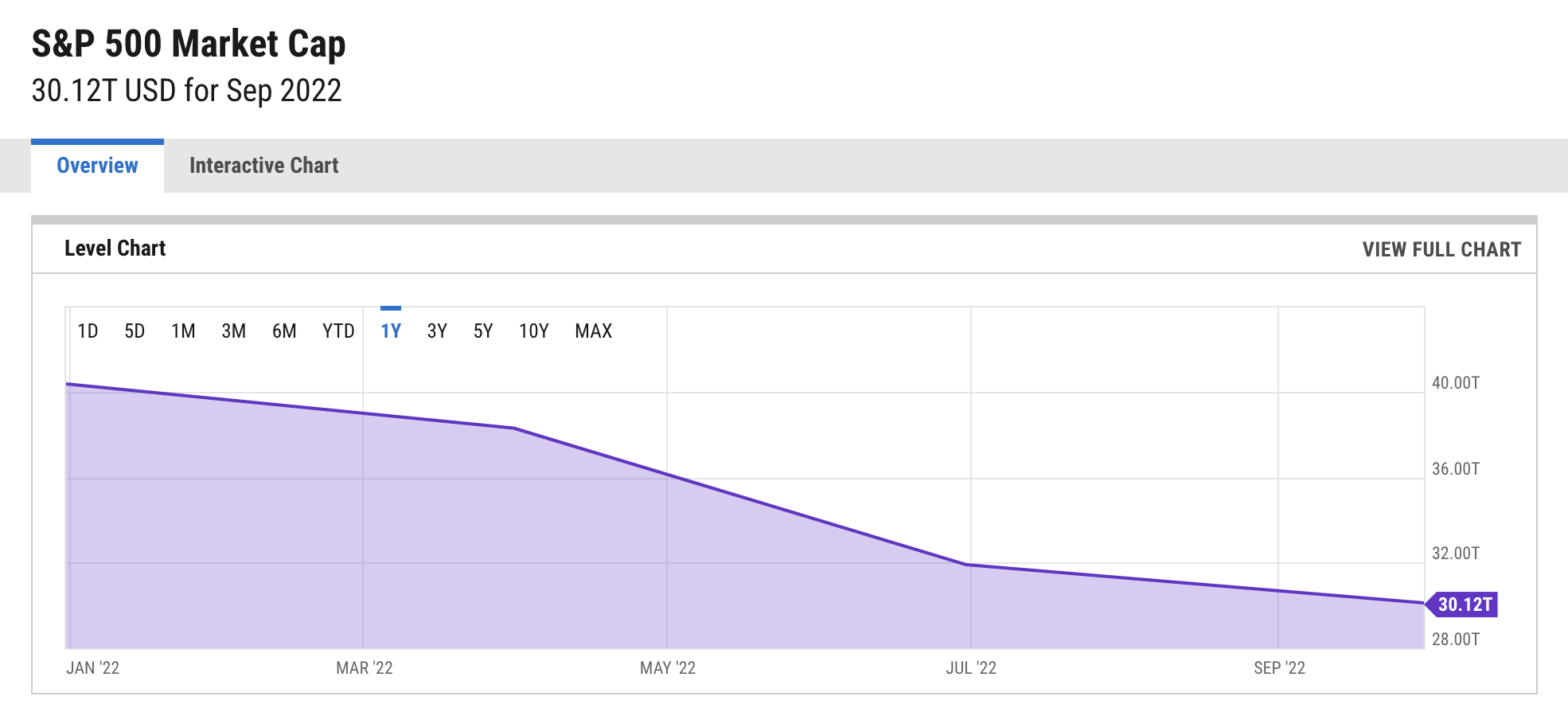

Just think of it this way, the companies in the S&P 500 have a market capitalization of 30.12 trillion dollars.

In December of 2021, the S&P 500 had a market capitalization of 40.36 trillion dollars. That’s roughly a 10 trillion dollar loss.

To put it in perspective, if Apple, Amazon, Google, Facebook, and Microsoft didn’t exist that would only be 6.8 trillion dollars (based on today’s stock price).

When the market goes down, the value of which companies are worth goes down, which means companies cut back on spending. Marketing happens to be the first thing that gets cut in a bad economy.

And when the value of companies goes down, a lot of people’s net worth goes down. Just in America alone, 43% of the population owns stocks.

So, when people’s net worth goes down, eventually they start spending less. It’s already started to slow too… when you look at data from the first half of this year (inflation-adjusted) spending increased by 1.5% compared to 12% last year.

But what about marketing?

Here’s what’s interesting…

Because our agency, NP Digital, works with companies of all sizes we see data from both small and medium …read more

Source:: Kiss Metrics Blog